The silver price has quietly become one of the strongest performers of this cycle.

Not crypto.

Surprisingly, no tech stocks.

And not even gold.

Silver.

We started digging deeper into why silver is moving like this.

And once you zoom out, the picture gets very interesting.

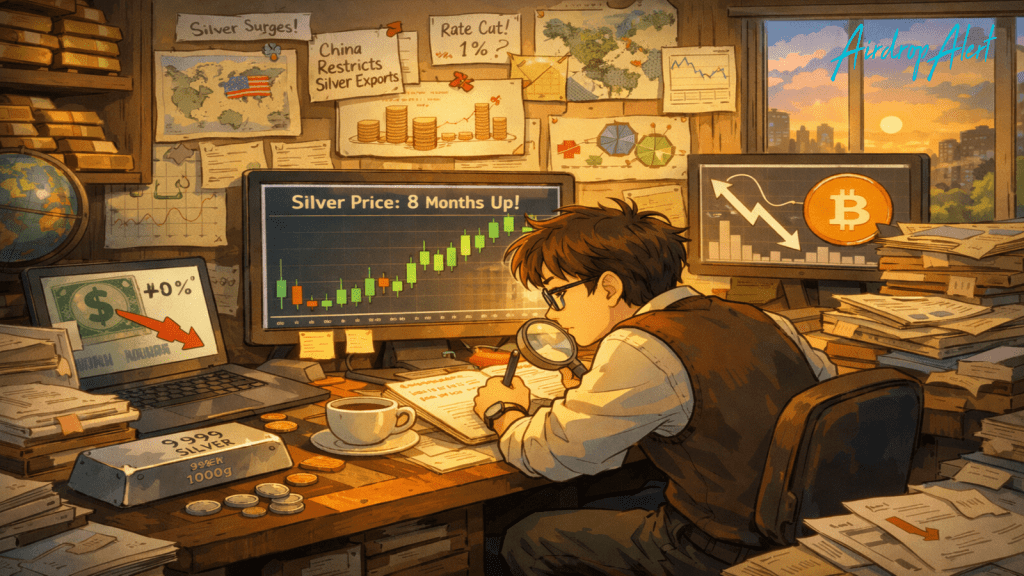

What is happening to the silver price right now?

The silver price is having one of its best runs in modern history.

We have now seen eight green monthly candles in a row.

The last time that happened was around 1979–1980.

On a yearly basis, silver is up roughly 170–175%.

That is not a typo.

For context, this means silver has outperformed:

• The S&P 500 by multiples

• Most global equity indices

• Bitcoin and the broader crypto market

• Even gold on a relative basis

Search interest for “silver” is now at an all-time high.

Retail is finally paying attention.

But price action alone does not explain this move.

The macro backdrop: why silver is benefiting now

Our core theme for 2025 has been simple. Own real assets, or get left behind. Don’t only hold crypto, hold some metals, some index funds, and real estate if you can.

That view has aged well.

Almost everything has gone up this year.

But precious metals have clearly taken the lead.

The main trigger was the US dollar.

A weaker dollar changes everything

The US dollar is down roughly 9% year-to-date.

This puts it on track for its worst year since 2017.

As rate cuts began, the dollar weakened further.

And markets are now pricing in even more easing ahead.

When President Trump was asked where he wants interest rates, his answer was direct.

“1%, maybe lower.”

That single sentence matters.

Lower rates mean:

• Lower real yields

• A weaker dollar

• Stronger hard assets

Silver thrives in this environment.

Why bonds are confirming the silver move

Normally, rate cuts should support bonds.

But that has not happened.

Since the Fed began cutting in late 2024, long-dated bonds have actually fallen.

Popular bond ETFs are still down double digits.

That tells us something important.

Long-term inflation expectations remain elevated.

And when investors lose faith in bonds as protection, they look elsewhere.

Gold and silver step in.

Central banks, China, and the physical squeeze

Central banks have been buying gold at a historic pace.

Purchases surged multiple times compared to previous years.

And China has been one of the biggest buyers.

What makes this more interesting is that China may be underreporting those purchases.

Unofficial estimates suggest real buying could be many times higher than reported.

Now add silver to the mix.

Starting January 1st, China will introduce export controls on silver.

Every export will require government approval.

The result?

Shanghai silver prices are already trading at a premium to US spot prices.

At times, that premium has reached several dollars per ounce.

This points to real physical tightness.

Read our 2025 recap of crypto, airdrops and more.

Money is moving fast.

Gold funds alone have seen tens of billions in inflows in just a few weeks.

That is the strongest inflow period ever recorded.

Silver usually follows gold.

But when it moves, it tends to move harder.

That is exactly what we are seeing now.

Silver versus crypto: an uncomfortable comparison

While precious metals are ripping higher, crypto has struggled.

Bitcoin is still down year-to-date.

That is despite a strong start earlier in the year.

In our view, this is not a fundamental failure of crypto.

It looks more like a mechanical reset driven by leverage.

But the relative performance gap is real.

Ratios tell the story:

• Silver has massively outperformed Bitcoin since mid-year

• Gold has also gained ground versus crypto

• The gold-to-silver ratio has compressed to levels not seen in over a decade

This suggests silver is not just riding gold’s coattails.

It is standing on its own.

Today’s silver crash: what likely happened

Now let’s address today.

After being up strongly just one day earlier, the silver price suddenly dropped nearly 15%.

That looks violent.

And it scared a lot of late buyers.

The likely trigger appears to be forced selling.

There are rumors that a futures-focused bank failed to meet a margin call.

When that happens, positions get liquidated regardless of fundamentals.

This kind of move is not unusual in leveraged commodity markets.

Sharp rallies build leverage.

Leverage eventually gets flushed.

That does not automatically mean the trend is broken.

How I am personally approaching this silver dip

I am treating this as an opportunity, not a warning.

My base case is that recession risks are rising.

And in that environment, I prefer to park part of my capital in hard assets.

I am allocating in stages.

Today, I entered roughly 25% of my intended silver position at $72.24.

I plan to scale in over the next two weeks.

This is how I usually approach non-crypto assets.

• Define a total allocation first

• Buy the first meaningful dip

• Keep dry powder in case volatility continues

Silver does not trade like meme coins.

I do not expect constant 30% drawdowns.

So I am not waiting for perfection.

Support Our Work

If you found this helpful, consider signing up on BloFin (Non-KYC) or Bybit using our referral links. Your support keeps this content free and flowing.

Trading silver in 2025: more options than ever

Another interesting development is accessibility.

Silver can now be traded on major crypto platforms like Bybit.

Even derivatives and perpetuals are available.

This means you can:

• Gain silver exposure

• Stay capital-efficient

• Even farm activity-based rewards

For example, trading silver perps can count toward certain airdrop programs, like on Aster.

That crossover between commodities and crypto is worth watching.

Final thoughts on the silver price

The silver price is not moving randomly.

This is a macro trade first.

A monetary trade second.

And a speculation trade last.

Volatility will remain.

Pullbacks will happen.

But as long as the dollar weakens, real yields stay pressured, and physical demand tightens, silver remains structurally interesting.

I am not chasing green candles.

I am buying controlled fear.

And if crypto catches up in 2026, great.

Until then, silver is doing exactly what a hedge is supposed to do.

If you enjoyed this blog, be sure to check out our recent post on the strong ZEC price action.

As always, don’t forget to claim your bonus below on Bybit. See you next time!