Binance has released its comprehensive State of the Blockchain 2025 report, revealing unprecedented growth metrics that reshape our understanding of cryptocurrency’s institutional adoption and retail participation. With $34 trillion in total trading volume, $7.1 trillion in spot markets alone, and institutional trading volume surging 21% year-over-year, the world’s largest exchange is operating at a scale that creates exponentially more opportunities for airdrop farmers and yield optimizers.

For crypto enthusiasts focused on maximizing returns through token distributions, these numbers tell a crucial story: the infrastructure supporting airdrops—from Binance Launchpool to Alpha trading programs—now operates with institutional-grade liquidity and security that makes strategic participation more rewarding than ever before. This report confirms what sophisticated traders already suspected: Binance’s ecosystem has become the primary gateway for retail investors to access institutional-quality opportunities, particularly through its expanding airdrop and rewards programs.

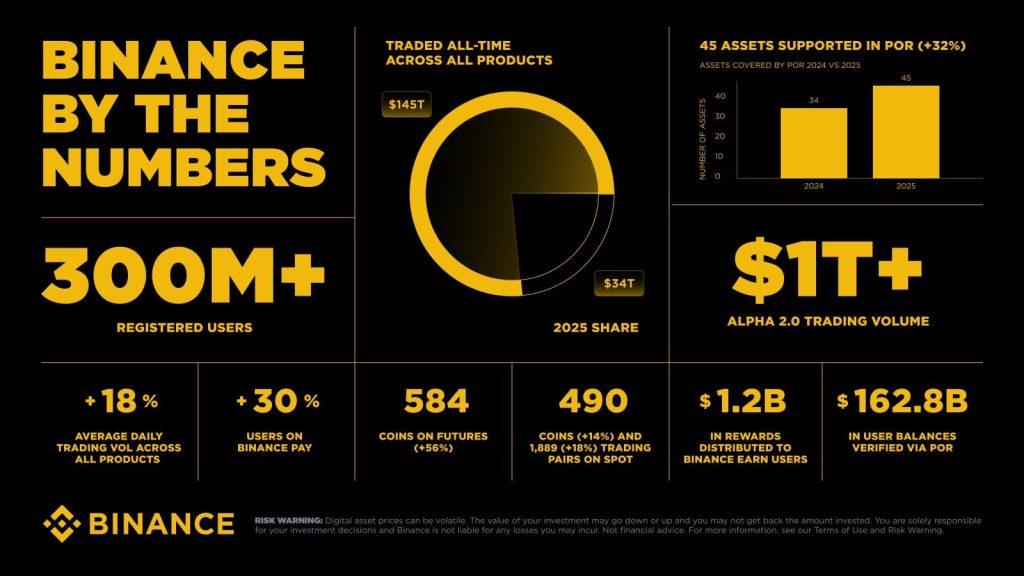

Breaking Down Binance’s $34 Trillion Trading Volume

The headline figure of $34 trillion in total trading volume for 2025 represents more than just impressive numbers—it demonstrates the liquidity depth that makes Binance the optimal platform for airdrop farming strategies. This massive volume broke down across several key metrics:

Spot Trading Dominance: Spot markets alone processed over $7.1 trillion in volume throughout 2025, with average daily trading volume increasing 18% year-over-year. This consistent liquidity ensures that when airdrop farmers need to convert rewards, execute trades, or rebalance portfolios, slippage remains minimal even for substantial positions.

Futures and Derivatives Scale: The remaining volume came from Binance’s futures markets, options trading, and leveraged products. For airdrop strategists, this matters because many token distribution programs reward users based on total platform engagement—meaning futures traders often qualify for multiple airdrop tiers while optimizing their core trading strategies.

All-Time Milestone: Binance’s cumulative trading volume reached $145 trillion across its operational history, cementing its position as the infrastructure backbone for global cryptocurrency markets. This historical depth creates trust signals that attract the highest-quality projects to launch tokens through Binance Launchpool and Megadrop programs.

The practical implication for airdrop farmers is straightforward: projects launching tokens want access to Binance’s liquidity. This means the exchange continues securing exclusive distribution rights for promising new tokens, making active Binance participation essential for comprehensive airdrop strategies. Our comprehensive Binance guide details exactly how to position yourself for maximum airdrop qualification across Launchpool, Megadrop, HODLer Airdrops, and Alpha rewards programs.

Institutional Adoption Accelerates Retail Opportunities

One of the most significant developments in Binance’s 2025 report is the 21% year-over-year increase in institutional trading volume, coupled with a staggering 210% surge in OTC fiat volume. These institutional metrics directly translate into enhanced airdrop opportunities for retail participants.

Why Institutional Growth Matters for Airdrops: When institutions increase their Binance activity, the exchange gains leverage to negotiate better token distribution terms with launching projects. This typically results in larger airdrop allocations, longer farming windows, and more generous reward structures for all users—not just institutional accounts.

VIP Trading Growth: VIP trading volume increased 18% year-over-year, reflecting sophisticated traders’ preference for Binance’s infrastructure. Many of these VIP users participate actively in airdrop programs, creating competitive pressure that pushes Binance to continually improve its rewards offerings to retain both institutional and retail users.

OTC Infrastructure Expansion: The 210% increase in OTC fiat volume indicates that major players now view Binance as their primary on-ramp for cryptocurrency exposure. This institutional stamp of approval attracts higher-quality token launches, which in turn creates better airdrop opportunities for users who maintain consistent platform engagement.

For newcomers looking to capitalize on this institutional-grade infrastructure, creating a Binance account provides immediate access to the same liquidity and security features used by major trading firms, while qualifying users for retail-focused airdrop programs that institutions often cannot access due to regulatory constraints.

Binance Alpha 2.0: $1 Trillion Volume Creates Airdrop Discovery Engine

Perhaps the most directly relevant metric for airdrop farmers is Binance Alpha 2.0’s performance: $1 trillion in cumulative volume with 17 million users onboarded. Alpha represents Binance’s curated platform for emerging tokens, essentially functioning as an airdrop discovery and early-access engine.

Alpha’s Airdrop Relevance: The Alpha program gives retail users first access to promising new tokens before they list on main markets. Many projects launching through Alpha implement retroactive airdrop programs for early traders, making Alpha participation a proactive airdrop farming strategy rather than reactive participation.

Volume Signals Quality: The $1 trillion volume milestone indicates robust market-making and genuine trading activity rather than artificial inflation. This liquidity depth means Alpha listings tend to maintain stable valuations, reducing the risk of dramatic price dumps that plague many airdrop rewards.

User Growth Trajectory: With 17 million users onboarded specifically to Alpha 2.0, Binance has created a massive community of early adopters who collectively influence which emerging tokens succeed. Projects recognize this influential audience, often structuring their tokenomics and airdrop programs specifically to attract and retain Alpha traders.

The strategic implication: maintaining active trading on Alpha-listed tokens can position you for multiple airdrop categories—direct project airdrops, Binance rewards for Alpha participation, and ecosystem incentives from projects building on chains represented in the Alpha portfolio.

Security Infrastructure Supporting $162.8 Billion in Proof-of-Reserves

Trust forms the foundation of sustainable airdrop farming, and Binance’s 2025 security metrics demonstrate why sophisticated users choose the platform for long-term strategies. The exchange prevented $6.69 billion in potential fraud losses while maintaining $162.8 billion verified through Proof-of-Reserves audits.

Fraud Prevention Impact: The $6.69 billion in prevented losses represents protection for users who might otherwise fall victim to phishing attacks, fake airdrop scams, or compromised wallets. Binance’s security infrastructure includes real-time monitoring that flags suspicious withdrawal patterns and phishing attempts specifically targeting airdrop participants.

Proof-of-Reserves Significance: The $162.8 billion in verified reserves exceeds customer deposits, demonstrating full backing plus additional security buffers. For airdrop farmers who accumulate substantial positions across multiple tokens, this reserve verification means your rewards remain secure even during market stress events.

Illicit Exposure Reduction: Binance achieved a 96% reduction in illicit exposure through enhanced compliance systems. This matters for airdrop participants because regulatory scrutiny increasingly focuses on token distribution mechanisms—clean compliance records protect both the platform and users from future regulatory actions that could freeze assets.

Law Enforcement Collaboration: The report highlights Binance’s expanded cooperation with global law enforcement agencies. While this might seem unrelated to airdrops, it actually ensures that tokens distributed through Binance programs won’t face unexpected delisting due to compliance issues discovered post-launch.

New users who sign up for Binance gain immediate access to this institutional-grade security infrastructure, protecting their airdrop positions from the day-one risks that plague less established platforms.

Payment Rails Expansion: 38% YoY Growth Opens Airdrop Monetization Channels

Binance’s payment infrastructure saw combined fiat and P2P volume increase 38% year-over-year, with Binance Pay growing to support over 20 million merchants. These payment developments create crucial infrastructure for airdrop farmers to monetize rewards efficiently.

Fiat On/Off Ramps: The 38% volume increase in fiat channels means reduced friction when converting airdrop rewards to local currencies. This matters particularly for smaller airdrops where gas fees might make direct crypto-to-crypto swaps uneconomical—direct fiat conversion often provides better net returns.

Binance Pay Merchant Network: With 20 million merchants now accepting Binance Pay, airdrop rewards become spendable assets rather than speculative holdings. This merchant acceptance creates real utility for tokens distributed through Binance programs, often supporting price stability that benefits late sellers.

Stablecoin Settlement Growth: The report indicates significant growth in stablecoin settlement activity through Binance Pay. For airdrop farmers, this creates immediate conversion pathways for volatile reward tokens into stable assets, locking in gains without triggering taxable events in many jurisdictions.

P2P Trading Volume: Peer-to-peer trading volume growth reflects geographic expansion into markets where traditional banking infrastructure struggles to serve crypto users. This expansion creates new airdrop farmer communities in emerging markets, often with less competition for token distributions compared to saturated Western markets.

Signing up for Binance provides immediate access to this comprehensive payment infrastructure, enabling efficient monetization strategies regardless of your geographic location or preferred settlement currency.

Binance Earn: $1.2 Billion in Rewards Distributed

The Binance Earn platform distributed $1.2 billion in rewards throughout 2025, representing one of the largest centralized staking and yield aggregation programs in cryptocurrency. This figure connects directly to airdrop farming strategies through several mechanisms.

Staking Rewards as Airdrop Qualifiers: Many projects distribute airdrops to users who stake tokens through official programs. Binance Earn serves as the largest aggregator of these staking opportunities, often negotiating enhanced APY rates that include both native staking rewards and supplementary token distributions.

Launchpool Integration: The $1.2 billion rewards total includes distributions through Binance Launchpool, the platform’s primary airdrop mechanism. Launchpool allows users to stake BNB, FDUSD, or other supported tokens to farm new token launches, creating a zero-risk airdrop participation method that returns your principal assets after each farming period ends.

HODLer Airdrops: Binance’s HODLer program automatically qualifies BNB holders for periodic airdrops from projects launching on BNB Chain. The $1.2 billion rewards figure reflects the cumulative value of these distributions, demonstrating substantial returns available to users who simply maintain BNB positions in their Binance wallets.

Flexible vs. Locked Staking: Binance Earn offers both flexible staking (allowing daily withdrawals) and locked staking (requiring commitment periods but offering higher APY). For airdrop farmers, flexible staking provides the liquidity to quickly respond to new farming opportunities while still generating passive rewards from idle assets.

The Earn platform essentially automates significant portions of airdrop farming, particularly for users who lack the time to manually track every new token distribution opportunity. Our comprehensive Binance guide provides detailed strategies for maximizing Earn rewards while maintaining flexibility for active airdrop participation.

Platform Breadth: 490 Spot Pairs and 584 Futures Assets

Binance’s support for 490 spot trading pairs, 1,889 total trading combinations, and 584 futures assets creates the market diversity necessary for sophisticated airdrop farming strategies. This breadth matters more than headline numbers suggest.

Token Coverage for Retroactive Airdrops: Many projects distribute retroactive airdrops to users who provided early liquidity or trading volume. With 490 spot pairs available, Binance users can strategically accumulate positions in emerging tokens that commonly implement surprise airdrop distributions to early supporters.

Cross-Chain Opportunities: The extensive futures asset coverage includes tokens from multiple blockchain ecosystems. Projects frequently distribute airdrops across chains based on trading activity—maintaining diverse futures positions can qualify users for airdrops from projects building on Ethereum, Solana, BNB Chain, and other supported networks.

Liquidity for Airdrop Exits: When farming airdrops from smaller projects, exit liquidity becomes crucial. Binance’s comprehensive listing ensures that even lesser-known tokens maintain sufficient trading volume for farmers to realize gains without dramatic slippage.

Pairs Strategy for Megadrop: Binance Megadrop, the platform’s premium airdrop program, often calculates rewards based on total platform engagement including trading volume across multiple pairs. The extensive pair availability means users can generate qualifying volume while executing legitimate trading strategies rather than wash trading for airdrop qualification.

New traders can benefit from industry-low trading fees when they sign up for a Binance account, making the exploration of these 490+ trading pairs economically viable even for smaller position sizes common in early-stage airdrop farming.

Strategic Implications for Airdrop Farmers

Binance’s State of the Blockchain 2025 report reveals several strategic insights for maximizing airdrop returns:

Institutional Infrastructure Attracts Quality Projects: The institutional adoption metrics—21% volume growth, 210% OTC expansion—signal that high-quality projects increasingly choose Binance for token launches. This quality filtering benefits retail airdrop farmers who gain exposure to vetted projects rather than the scam-heavy environment on smaller platforms.

Liquidity Depth Enables Larger Positions: The $34 trillion trading volume creates market depth that allows airdrop farmers to accumulate larger positions in target tokens without price impact. This position sizing flexibility becomes crucial when projects implement tiered airdrop structures rewarding larger holders with exponentially better allocations.

Security Infrastructure Reduces Custody Risk: The $6.69 billion in prevented fraud losses and $162.8 billion in verified reserves mean airdrop positions remain secure during accumulation phases that often span months. This security infrastructure becomes especially valuable when farming airdrops from emerging projects where wallet vulnerabilities might exist.

Payment Rails Support Profit Realization: The 38% growth in fiat/P2P volume ensures that when airdrop farming strategies succeed, farmers can efficiently convert rewards to fiat currencies or stablecoins, locking in gains rather than remaining exposed to market volatility.

Earn Automation Reduces Opportunity Cost: The $1.2 billion in Earn rewards demonstrates that even inactive positions generate returns on Binance. This automation ensures that assets waiting for the next airdrop farming opportunity aren’t sitting idle but instead accumulating supplementary yields.

Platform Consistency Enables Long-Term Strategy

One metric deserves special attention: Binance’s 18% year-over-year increase in average daily trading volume. This consistency indicates sustainable growth rather than temporary spikes, which matters immensely for airdrop farmers developing multi-year strategies.

Predictable Liquidity: Consistent daily volume means airdrop farmers can reliably plan entries and exits without concern for temporary liquidity droughts that might force suboptimal trade timing.

Sustained Project Interest: Projects evaluate potential listing venues partly based on trading volume consistency. The 18% growth trajectory signals to launching projects that Binance users remain actively engaged, making the platform attractive for premier token distributions.

Reduced Platform Risk: Exchanges with volatile volume patterns face higher regulatory scrutiny and potential operational challenges. Binance’s consistent growth reduces the platform risk component in airdrop farming strategies that require long-term asset custody.

Community Stability: Steady volume growth indicates a stable user community rather than speculative influxes during bull markets. This community stability means airdrop farmers can build relationships, share strategies, and collectively benefit from group participation in programs that reward community engagement.

Users who create a Binance account unlock access to this consistent, growing ecosystem where airdrop opportunities continue expanding rather than diminishing as the platform matures.

The Binance Alpha Advantage for Early-Stage Farming

Returning to Alpha’s $1 trillion volume milestone: this figure represents the most significant infrastructure development for proactive airdrop farming. Unlike reactive strategies where farmers wait for airdrop announcements, Alpha participation enables position-building before projects implement token distributions.

Pre-Announcement Accumulation: Alpha listings often precede formal airdrop announcements by weeks or months. Early traders who accumulate positions during Alpha phases frequently qualify for enhanced airdrop tiers when projects eventually announce retroactive distributions.

Volume-Based Qualifications: Many Alpha projects structure airdrops using trading volume thresholds. The $1 trillion cumulative volume across Alpha indicates robust trading activity that pushes farmers toward higher qualification tiers through natural trading behavior.

First-Mover Advantages: The 17 million users onboarded to Alpha creates competition, but also demonstrates sufficient liquidity for early traders to establish meaningful positions. First-mover advantages in Alpha trading often translate to better airdrop allocations when projects reward earliest supporters.

Risk-Adjusted Returns: Alpha tokens trade with live market prices rather than speculative pre-launch valuations. This price discovery mechanism means farmers can assess risk/reward ratios before committing significant capital to emerging tokens that might implement airdrops.

Signing up for Binance provides immediate Alpha access without separate applications or waiting lists, democratizing early-stage opportunities traditionally reserved for venture capital firms and insider networks.

Connecting Volume Metrics to Practical Strategy

The State of the Blockchain 2025 report’s numbers translate into specific tactical advantages:

$34T Total Volume = Maximum Slippage Protection: Execute large airdrop conversions without price impact concerns, protecting profits from technical selling friction.

$7.1T Spot Volume = Optimal Pair Availability: Find liquid markets for even obscure airdrop tokens, ensuring monetization pathways regardless of token popularity.

21% Institutional Growth = Better Project Vetting: Benefit from institutional due diligence that filters low-quality projects before they reach retail airdrop programs.

$1T Alpha Volume = Early Access Infrastructure: Position yourself in emerging tokens before mainstream awareness drives price discovery.

$6.69B Fraud Prevention = Secure Accumulation: Build airdrop positions over extended timeframes without custody concerns that plague smaller platforms.

$1.2B Earn Rewards = Automated Yield: Generate returns from idle assets between active airdrop farming opportunities.

These metrics collectively demonstrate why sophisticated airdrop farmers consolidate activity on Binance rather than fragmenting across multiple platforms with weaker infrastructure.

Risk Management Considerations

While Binance’s 2025 metrics paint an overwhelmingly positive picture, prudent airdrop farming requires acknowledging ongoing risks:

Regulatory Evolution: Despite improved compliance (96% illicit exposure reduction), global cryptocurrency regulation continues evolving. Airdrop farmers should diversify across multiple platforms and self-custody options rather than maintaining 100% exposure to any single exchange.

Market Concentration: Binance’s dominance creates systemic risk where exchange-specific issues might affect broader market liquidity. The $34 trillion volume concentration means significant platform disruptions could impact asset valuations globally.

Airdrop Tax Complexity: The $1.2 billion in Earn rewards and associated airdrop distributions create complex tax reporting obligations. Farmers should maintain detailed records and consult tax professionals familiar with cryptocurrency regulations.

Opportunity Cost Management: While Binance offers extensive airdrop programs, exclusive opportunities occasionally emerge on competing platforms. Complete Binance focus might cause farmers to miss certain distributions available only through alternative venues.

The security infrastructure detailed in the State of the Blockchain report—particularly the Proof-of-Reserves verification and fraud prevention systems—mitigates many platform-specific risks, but prudent diversification remains essential for long-term success.

Looking Forward: What 2025 Metrics Signal for 2026

The State of the Blockchain 2025 report provides valuable insights into likely 2026 developments:

Continued Institutional Adoption: The 21% institutional volume growth and 210% OTC expansion suggest accelerating institutional participation throughout 2026, likely bringing additional high-quality token launches and enhanced airdrop programs.

Payment Infrastructure Maturation: The 38% fiat/P2P growth and 20 million merchant Binance Pay adoption indicate cryptocurrency moving toward mainstream payment utility, which should support airdrop token valuations through expanded real-world use cases.

Security Framework Expansion: The $6.69 billion fraud prevention total and enhanced compliance systems suggest Binance will continue investing in security infrastructure, protecting airdrop farmers from increasingly sophisticated scam attempts.

Alpha Ecosystem Growth: The $1 trillion volume milestone positions Alpha for continued expansion in 2026, potentially introducing tiered access levels or enhanced rewards for consistent Alpha traders.

Earn Product Innovation: The $1.2 billion rewards distribution likely drives new Earn product development, possibly including enhanced Launchpool mechanisms or innovative airdrop distribution methods that reward long-term platform engagement.

These forward-looking signals suggest that airdrop farming strategies built around Binance’s ecosystem should remain viable and potentially increase in profitability throughout 2026 and beyond.

Ready to capitalize on Binance’s record-breaking infrastructure and position yourself for 2026’s airdrop opportunities? Sign up for Binance here to access the world’s most liquid crypto markets with reduced trading fees and exclusive fee rebates for new users. Start trading with as little as $10 and join millions of traders already benefiting from Launchpool, Megadrop, HODLer Airdrops, and Alpha early-access programs.

Risk Warning: Cryptocurrency trading and airdrop farming involve substantial risk of loss. The volatile nature of cryptocurrency markets means airdrop rewards can decrease in value rapidly. Never invest more than you can afford to lose. This article provides educational information only and does not constitute financial advice. Always conduct thorough research and consider consulting financial professionals before making investment decisions.